VanEck and BetaShares Await Approval for Aussie Bitcoin ETF

As Australians venture deeper into the crypto market, fund managers in the country are racing to seek approval from regulators for the first Bitcoin ETF.

Two companies that have submitted formal proposals for review and approval by the Australian Securities Exchange (ASX) are VanEck and BetaShares. The move comes despite reports in May suggesting the regulator remains wary of signing-off on a bitcoin ETF.

Plans to launch Bitcoin ETF

The regulator has confirmed that several investment companies have been making plans to launch Bitcoin ETFs. The chief executive for VanEck in the Asia-Pacific, Arian Neiron, stated that the crypto market was growing and if the ASX approved the ETFs, it would create a safe regulated space for investors.

BetaShares, an ETF provider based in Australia, stated that they had made an application to the ASX. However, the provider’s proposed ETF product did not specify whether the ETF would be directly linked to Bitcoin or other digital assets. The managing director for the company, Alex Vynokur, confirmed the application submission, explaining that it was in response to increasing demand for a bitcoin ETF product.

The ASX did not release any details of the BetaShares application. However, an ASX spokesperson said it was taking an interest in developments and had some concerns, adding that it was closely monitoring Bitcoin and the wider cryptocurrencies market.

Wealthy families are buying crypto assets

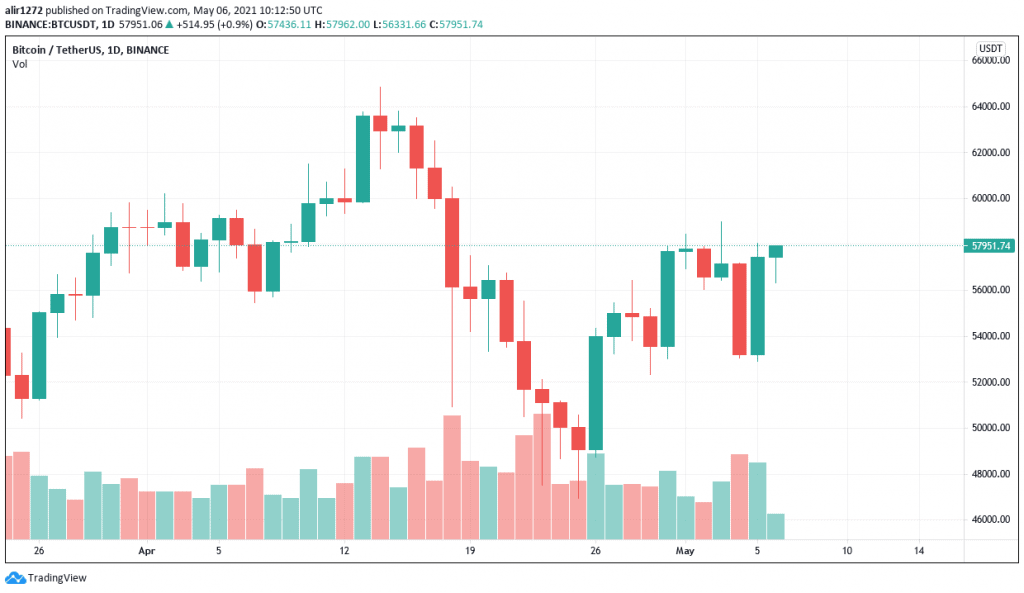

The bullish trend for cryptos in Australia has been witnessed in recent weeks as wealthy investors expand their portfolios using crypto assets. Financial website Businesss Insider recently revealed that crypto investment firm DigitalX is helping a growing number of family offices to invest in digital assets.

Leigh Travers, the executive director of DigitalX, said that high net worth investors were replacing some of their gold holdings with bitcoin. He also added that bitcoin had changed from being an asset bought solely for speculative purposes, into one held as a portfolio diversifier and protection against currency debasement and rising inflation worries.

The average family office in Australia and New Zealand is thought to hold investments valued at more than $600 million. As these institutions diversify into crypto assets, even a small percentage allocation of total assets – say under 5% – would translate into a large injection of money going into crypto.

The Australian Securities Exchange has also urged firms to become more forthcoming in engaging with them. This will enable it to speed up the process of developing innovative solutions in the region.

Towards the end of April, US regulator the Securities and Exchange Commission (SEC), which has received a number of applications for a Bitcoin ETF, announced that it was delaying the reviews of the proposals until June.