Bitcoin (BTC) Price Prediction: BTC/USD Consolidates Above $48K as It Defends Critical Support

Bitcoin Fluctuates in a Range as It Defends Critical Support – August 29, 2021

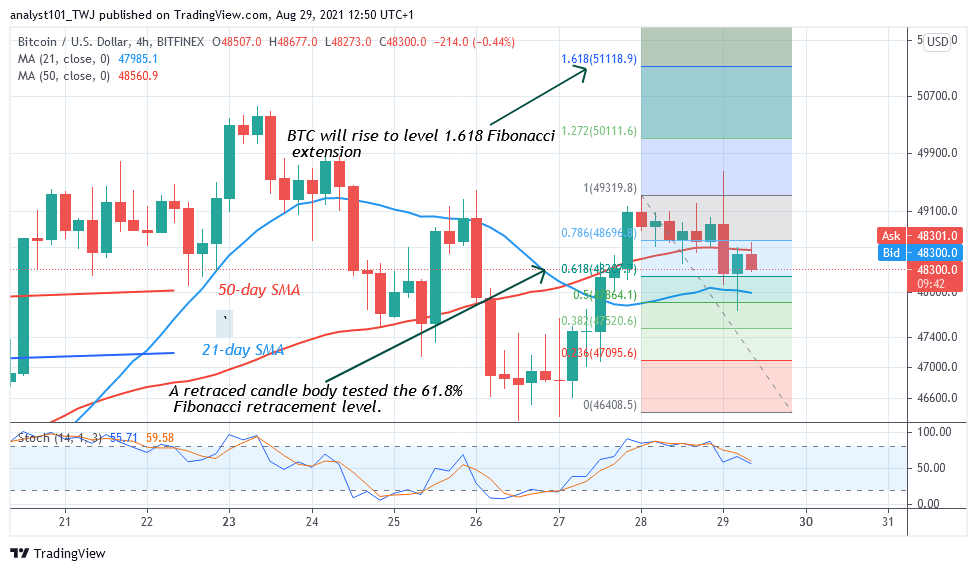

Today, the Bitcoin price has dropped sharply above the $48,000 support. The implication is that buyers have the advantage to push BTC price to retest the $50,000 overhead resistance. Today, if the bears break below the $48,000 support, it will signal the resumption of the downtrend. Incidentally, the crypto is likely to be range-bound between $48,000 and $49,500 price levels. Bitcoin will resume an uptrend above $50,000 high if buyers break $49,500 resistance and the bullish momentum is sustained. However, repeated rejections at the overhead resistance will cause Bitcoin to decline below $48,000 support. The Relative Strength Index period 14 is at level 58. It indicates that Bitcoin has room to rally on the upside.

Bitcoin on-chain activity stays low despite price rally: Data

According to new data, cryptocurrency investors are not moving their holdings, despite BTC prices growing by 45% over the past 30 days. This has caused Bitcoin on-chain activity to drop after May 2021’s crypto market crash. According to Bitcoin on-chain activity, such as the amount of entity-adjusted transactions, is yet to respond to the ongoing bullish action. It remains at historically low levels of between 175,000 and 200,000 daily transactions.

Meanwhile, BTC’s price is now consolidating above the $48,000 support as it defends critical support. Meanwhile, on August 28 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates that the BTC price will rise to level 1.618 Fibonacci extension or level $51,118.90.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider